(UPDATE – See my follow-up post for more measures of the industry)

To follow up on my earlier take on eikaiwa as the gaijin community’s whipping boy, I want to try and paint a dispassionate, quantitative picture of the eikaiwa industry itself.

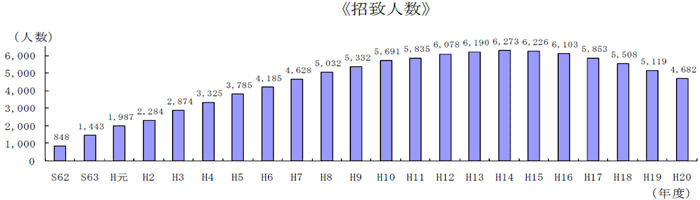

Back in summer 2006, I noted that the number of participants (newcomers plus extended contracts) in the JET program had been falling steadily after peaking in 2002 at 6,273. A quick check of the MIC website shows that this trend has continued through 2008 (click image and scroll down for better resolution).

The 2008 total was 4,682, 25.4% down from the peak. I would expect the pace to slow down a bit, considering they recently extended the maximum contract length from three years to five.

Non-JET ALTs/eikaiwa

In the private sector, METI figures (Excel) show the number of instructors at regulated “foreign language conversations schools” peaked in 2003 at 13,365, but stood at 9,591 as of the end of 2008, down by 28.3% from the peak and 22.4% since the JET Program’s peak.

Figures are less forthcoming about a third segment of the market, non-JET ALTs at schools across the country, but they are available. According to an October 2008 report from the Chunichi Shimbun (thanks Let’s Japan), the number of non-JET ALTs surpassed JETs in 2006, and by 2007 represented 60% of all ALTs or nearly 8,000 people.

(A quick aside: There is some evidence that the education ministry views the issue of “temporary and contract” ALTs as a considerable problem, as these non-JETs can fall through the cracks in terms of supervision, training, and visa compliance. In February 2005, the ministry issued a letter to boards of education nationwide warning them to ensure that contracts with non-JET ALTs are “appropriate” (apparently in response to unfavorable press coverage) (source).)

Unfortunately, I am having trouble locating the exact figures for non-JET ALTs over time. They can be found by combining the totals of education ministry surveys given to schools asking the status of their English-language education. The only trouble is, the surveys are separated by scholastic level; and they aren’t neatly organized by year.

But I was able to find the total for 2002: 3090. So put together, here is the breakdown of “market share” of instructors in all three segments for 2002 and 2007 (click for full size):

Non-JET ALTs appear to be quickly becoming the dominant employment type in the industry. JETs went from outnumbering non-JET ALTs 2:1 from being outnumbered by them 3:2. Possibly on a related note, this ratio (1/3 of all instructors are temp/contract) is consistent with the overall ratio of non-permanent workers in the overall workforce.

The tables were turned for conversation schools vs. ALTs as well. The end of 2007 was right when NOVA collapsed, and before that several other schools went bankrupt. This no doubt pinched the number of private teachers.

Interestingly, the totals of both years indicate that the pie was still growing as late as the end of 2007: the total number of teachers grew 7%, from 21,729 in 2002 to 23,130 in 2007. This growth rate matches the 7.0% growth in US citizen registered foreigners over the same period, though it underperforms the overall 16% growth in the number of registered foreigners (PDF). Japan’s total workforce (seasonally adjusted (Excel)), meanwhile, declined 10.1% during this period.

(Note that there are some considerable limitations to this data, though I think it at leasts provides a good chunk of the overall picture. First, I have included all JETs in the total, out of the consideration (emphasized by Curzon) that ALTs, CIRs, and those special physical education instructors all serve the purpose of “internationalization.” Also, “conversation schools” cover languages other than English, though I think it is safe to say English continues to be the overwhelmingly most popular language. There may be some overlap in the “conversation school” and “non-JET ALT” category as some businesses classified as conversation schools might also list non-JET ALTs as “instructors” resulting in some double-counting. These numbers also do not cover private lessons and unregistered schools, nor does it cover some of the related markets, such as private-sector study abroad, English teachers at universities, full-time foreign English teachers at schools, English teaching services provided by foreign governments such as the British Council, Internet services/podcasts, broadcast lessons such as those given on NHK, and book and CD publishing, all of which could add up to hundreds more teachers.)

Prospects – private sector

Although the supply of teachers grew backed by the surge in non-JET ALTs, eikaiwa as a business appears to be shrinking very fast (Excel). After falling for three years starting in 2003, sales boomed in 2006, whereafter the bottom appears to have fallen out from under the industry (Y axis unit = 1 million yen. Click for full-size):

This precipitous drop coincides with reports at the time of oversupply in the eikaiwa market as the big schools such as NOVA rushed like mad to open schools in every corner of the country. The following years saw the collapse of several schools including NOVA, the former market leader. (UPDATE: this drop also coincides with legal revisions that made it easier for dissatisfied students to request refunds). Teachers may face some serious difficulty as the excess supply adjusts to match demand. This drop in sales far outpaces that of firms listed on the Tokyo Stock Exchange, which are expected to face a year-on-year 6.5% drop for FY2008 (final profits are a different story, but without sales there isn’t much hope of making a profit, is there?).

During this time, Japanese households’ discretionary income fell 1.9% (though slightly less in real terms). With the reputation of the industry damaged and Japanese households concerned about their basic livelihoods, it seems hard to expect that the workers’ desires to make their skills more competitive will save any but the highest quality businesses in this industry.

Prospects – public sector

Meanwhile, recent economic turmoil (annualized 12% GDP shrinkage for Oct.-Dec. 2008 makes Japan the hardest-hit G-7 economy) could put pressure on the public sector as well, as described in a previous comment by Aceface:

I have to wonder how many eikaiwa community understand gloomy future ahead of them. Many local government are now facing rapid decline of corporation tax income due to the down sizing of production in Toyota factories, ANd under such circumstances we can no longer justify this 21st century version of “Oyatoi-Gaijin” we know as JET/ALT.

Aichi, Shizuoka, Gihu, Mie and Gunma need as much Portuguese/Japanese bilingual staffs as possible since there are tons of works must be done starting from job education for the unemployed. And since they have no extra budgets,most likely gone will be “international exchange”related posts.

While I am not sure what the rules are for funding non-JET ALTs (I am assuming schools can choose to use local taxes, or private schools their budgets), the JET program is funded by redistributed local taxes (chihou koufuzei), doled out to prefectures and municipalities at a pre-determined ratio, plus extra for local administrations with particular plans to use the money. The funds come from “the five national taxes” – income tax, corporate income tax, consumption tax, alcohol tax, and tobacco tax. The income taxes have been on a downward growth trend since the 1990s, while consumption tax has emerged to rival those as a revenue generator. The sin taxes have maintained a consistent, relatively low holding pattern. The redistribution amount peaked in 2001 and has been falling roughly in line with the corporate income tax. Though 2008 tax receipts were forecast to be up slightly (possibly due to the tax bills for earlier profits), original finance ministry estimates appear to have fallen far from the mark, failing to anticipate the dismal corporate earnings, rising unemployment, and stagnant consumption. This means the major tax revenue sources are expected to fall significantly.

Conclusion

English teaching in Japan looks like it is in for a very rough patch. While this exercise hasn’t been exactly a happy one, I hope it’s been informative. It certainly has been for me.

UPDATE: I have posted some more data on the industry in a follow-up.