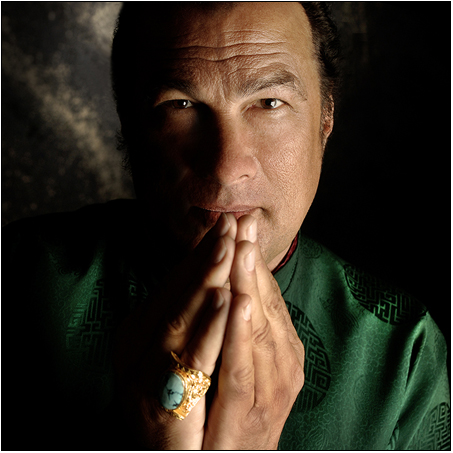

Not as good as this guy’s

Just want to get something off my chest. I’ve been studying Japanese for almost 15 years, spent two of them studying abroad, lived in Tokyo for five years now, passed the JLPT 1 and the Securities Representative exam in Japanese, worked as a Japanese-English translator for around 7 years, and on and on. I’ve done a lot of stuff that would seemingly require near-native fluency, and yet…

My Japanese still sucks. I feel like no matter how much I study or live in the country I am always going to have a rough accent, a low working vocabulary, and generally limited fluency. My reading will always be much much slower than a native, and I will forever be looking up kanji on my iPhone even to write my own address half the time. My wife will be afraid to let me go to the doctor alone lest I misunderstand some important detail. I’ll never feel comfortable speaking in public or leading a group conversation among natives. If someone doesn’t feel like being patient with me there’s not a whole lot I can do to take control of the situation.

I feel like I have improved a lot and developed a pretty good working use of the language, but on an objective level it’s just terrible. I’d like to go around thinking I have really achieved something by learning another language and making a career of it, but I need to be honest.

In the US there is a very simple standard for English fluency – either native or foreign. You don’t get any prizes for having 50% fluent English or even 90%. But of course here, Japanese people tend to be overflowing with praise for a Westerner who speaks the language. They make it sound like it’s such an amazing achievement. But anyone who grows up here will learn Japanese – it’s just a way for people to communicate. I don’t think knowing it means you deserve any special credit. I guess I should be grateful that the bar is so low and so many people are willing to be patient with me.

I can only speak for myself, but I get the feeling that a good deal of the long-term Western residents are like me. They’ve developed a good working fluency but will probably never really reach native level. I think that’s great and worthy in its way, but for me I don’t want to lose sight of reality.

There are ways that I could improve, maybe, and I do want to get better. I want to just live a normal life without worrying about the language barrier. It’s demoralizing to stutter and fumble words at my job or even just trying to ask a store clerk something. Having better Japanese and the social skills to use it (a big one here) would make it much easier to disarm situations where people are uneasy about dealing with a foreigner. I have definitely not been in the habit of actively trying to improve my Japanese for quite a while now – at this point in my life (almost 30) my priorities are work and spending time with Mrs. Adamu. Spending extra free time writing kanji is not my idea of fun anymore.

People laughed Debito’s column about not having male Japanese friends, but I actually kind of identified with it to an extent. I don’t hang out with many Japanese people, and next to zero men. Unlike Debito, however, I don’t really blame Japanese people for not being sophisticated enough to understand me. I instead put most of it down to the language/cultural barrier and my own social awkwardness. There are lots and lots of people with similar backgrounds who have successfully integrated, either going native or on some other terms, and they can just make it work in a way that I haven’t been able to.

Maybe what’s made things worse is that my Japanese has improved to a level where I know what it means to speak at a native level and the difference when someone falls short. At the risk of comparing myself to people with real problems, it’s like a disabled person who knows what it’s like to walk but just can’t make his body do what his brain is telling it.

Anyway that’s something I have been wanting to post on Mutant Frog for a while now because I don’t want to put out this image like my Japanese is so amazingly awesome when it’s not. That’s definitely not how I used to feel (I think I have written that I “get” Japan better than other people on more than one occasion) but I am way overdue for some humility.