But owning a monkey isn’t inherently political.

Link.

I think what he’s trying to say is that the second ammendment protects my right to bear deadly robotic monkey arms.

But owning a monkey isn’t inherently political.

Link.

I think what he’s trying to say is that the second ammendment protects my right to bear deadly robotic monkey arms.

Apparently last month Tokyo hosted the Eco-products 2005 trade show.

I’m sure they had a lot of interesting exhibits

but what really stands out for me is their mascot.

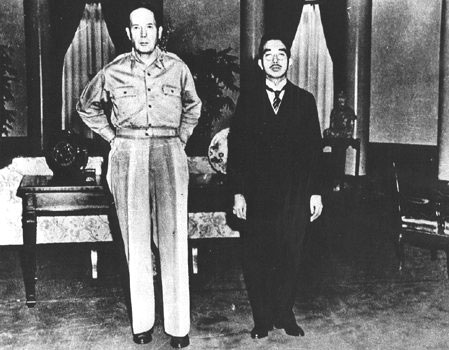

September 27, 1945

November 16, 2005

A few quick thoughts I had while reading the following in the Japan Times:

In a document submitted to the Diet on Nov. 18 upon formal Cabinet approval, the government had pledged to send officials to check U.S. meet processors prior to resuming beef imports in December.

Without notifying the Diet, however, the government postponed the dispatch of officials to the United States, claiming it was found that inspections before imports were resumed would be impractical.

Nakagawa has been under fire from opposition parties for changing the dispatch plan without informing the Diet.

Now, I don’t often side with the GOJ on the beef issue. And I don’t know the details of what actually happened leading up to the government’s decision to postpone the dispatch of inspectors. However, it seems that Nakagawa might have been in an even worse pinch had inspectors been sent prior to the discovery of spinal matter in imported beef last month.

Sending inspectors to U.S. meat-processing facilities would have amounted to nothing more than a symbolic gesture at best. It would have been a signal to the Japanese public that the government is taking this problem seriously. But let’s face it – a few Japanese inspectors would not have prevented the gross negligence on the part of the United States that resulted in the re-imposition of the beef ban.

Their presence would, however, have distributed some of that negligence towards the Japanese government. Opposition parties, always eager to sink their teeth into LDP hide, would have then dismissed the government’s inspection measures as ineffective.

In hindsight, one has to ask which is worse for the government: having hidden the decision to delay sending the inspectors and having some spinal material show up in an imported veal shipment, or having sent the inspectors only to have the effort proven completely unsuccessful?

[This post originally appeared on my no longer active Laughing Monkey site on March 12, 2005.]

Recent developments in the ongoing takeover battle between internet upstart Livedoor and old guard Fuji Television for control of Japan Broadcasting are making things interesting for Japan watchers.

Yesterday came the unexpected news that the Tokyo District court had ruled in favor of Livedoor, ordering NBS to halt its intended direct issuance of new shares to Fuji in an effort to dilute Livedoor’s holdings. Yahoo! Asia News ran this rather optimistic analysis of the ruling, describing the court’s decision as, “turning the clock forward on Japan’s capital markets.

Experts say the closely watched decision goes in line with Japan’s goal of easing regulations on the financial sector to gain a global competitive edge, easing worries that foreign investors otherwise might have shied away from making further investments in the country.

But if foreign investors were reassured by this positive news, then surely they were equally disaopointed by reports from sources inside the the ruling Liberal Democratic Party that the government was moving towards further restrictions on the activities of foreign companies.

An LDP panel on legal affairs decided at its meeting Friday to ask the Justice Ministry to change the bills regarding restrictions on M&As by foreign firms to postpone theimplementation of the step to 2007 from the originally planned 2006, the sources said.

The planned bill on M&As by foreign firms also include measures against hostile takeover bids, such as the so-called poison pill, designed to discourage bidders by increasing the takeover costs usually through the issuance of equity warrants.

So while Livedoor appears to have scored at least a temporary legal victory in its efforts to get at Fuji Television through control over its largest shareholder NBS, the successful passage of such a bill by the Diet would ensure that there will be no such future victories.

Why? Consider this observation from Youichi Yanai, chief fund manager at Tokyo Mitsubishi:

Permitting the use of `poison pill’ tactics would leave investors highly skeptical about the overall Japanese market and the very meaning of having a fair and functional capital market…

So much for easing the worries of foreign investors.

And, if these mixed messages weren’t confusing enough, today came reports that Fuji Television may be reconsidering its tactics and might seek out some sort of cooperative partnership with Livedoor.

Fuji Television Network Inc. Chairman Hisashi Hieda said past midnight Friday that his company may form a business tie-up with Livedoor Co., voicing the possibility for the first time in the monthlong battle with the Internet company over control of NipponBroadcasting System Inc.

Hieda has previously categorically rejected a tie-up offer from Livedoor and the about-face was apparently triggered by a court ruling earlier Friday in favor of Livedoor over the acquisition battle.

“If there are some merits, we can consider forming a business alliance with Livedoor,” Hieda told reporters following the decision by the Tokyo District Court to bar Nippon Broadcasting from selling massive equity warrants to his company in a bid to thwart Livedoor’s hostile takeover bid.

So, should these developments to be taken as a positive sign that Japan is finally changing, or might it merely be once again creating false hopes? I’m not holding my breath, but this is one case where I would happily admit to being wrong.

Still, the type of drama currently unfolding in the court system has all been seen before. In a worst case scenario, this may be turn out to be a repeat of the fight late last year between megabanks Mitsui Sumitomo and Tokyo Mitsubishi over a merger deal with ailing rival UFJ. Although Mitsui Sumitomo appeared to be gaining ground early on with its victory at the district court level, the Supreme Court later overturned the lower court’s ruling, effectivly giving Tokyo Mitsubishi the green light to proceed with the merger, much to Mitsui Sumitomo’s chagrin. If NBS appeals yesterday’s ruling, as appears likely, there is a good chance that the Supreme Court will rule in its favor.

In the past, there have simply been too many examples of outsiders, both Japanese and foreign making progress and then having the door shut in their faces by defenders of the good old days.

I have been busy, but apparently Goro-san has been writing a LOT. So I am only going to go after the parts where he talks about the relationship between him and his father. Here we go:

Yesterday I saw a pre-screening of Mamoru Oshii’s latest, “Biographical Vignettes of Dr. Tachigui” at the Ghibli screening room. But before I give my thoughts on that, I’ll tell you an anecdote.

20 years ago, when I was still a high school student, I met Director Mamoru Oshii.

The place was at my grandfather’s cottage in Shinshu (more of a mountain shack than a cottage).

The time was the middle of summer, I remember.

At the time, Oshii-san, in his mid-30s, was the very picture of a rosy-cheeked beautiful (?) youth, and his white running shirt made an impression on me.While we were at the cottage, Oshii-san and my father would argue for hours on end over their theories of animation.

The previous year or so, Director Hayao Miyazaki’s “Nausicaa of the Valley of the Wind” and Director Mamoru Oshii’s “Urusei Yatsura 2: Beautiful Dreamer” were released.

At the time, I preferred Urusei Yatsura 2, and learned later that my opinion had been communicated to Oshii-san.Anyway, back to what I was talking about.

Maybe because he remembers that, Oshii-san apparently has a unilateral fondness for me, and really wanted me to see “Biographical Vignettes of Dr. Tachigui.”

I wish all the success in the world for Oshii-san.

So my thoughts, briefly:

Once more, on the same theme, I’d like you to make an effort toward entertainment that puts service first.

That is all.

This headline was much more interesting than the article.

My previous post on possible linkages between the Livedoor scandal and Foreign Direct Investment in Japan got me curious about the latter topic, so I did a little reading over the weekend.

I started with last year’s report by U.S.-Japan Business Council on expanding FDI in Japan. This is a fascinating and surprisingly easily approachable document that I strongly recommend to anyone with an interest in investment issues is Japan.

Below are a few of the more interesting points from the report, along with some graphical illustrations I worked up using data from the United Nations Committee on Trade and Development’s annual World Investment Report, and the Ministry of Finance‘s on-line FDI data.

Japan’s inward FDI falls well below international standards:

At 2.1% of GDP, the accumulated foreign direct investment (FDI) in Japan is much less than the average of 20% for all developed economies, and G-7 economies such as the United States (14%), Germany (22%), and the United Kingdom (37%).

In spite of the quantitative difference, the composition in terms of type of investment is very similar to other developed countries:

According to the OECD, over 70% of the FDI in developed economies takes place via Mergers and Acquisitions (M&A), transactions in which one company acquires a whole or partial ownership stake in another. Japan is no different. Over 70% of FDI in Japan since 1997 has been through M&A.

Still, Japan still falls far behind the pack in cross border M&As.

Furthermore, a large number of these M&As share a similar characteristic:

Where most of these Japanese/U.S. and U.S./EU transactions can be characterized as “friendly” transactions, most foreign acquisitions in Japan are cases in which U.S. or European firms acquired stakes in financially troubled Japanese companies. The Japanese companies generally agreed to be acquired only because they needed capital to survive.

Regular readers of Japanese news are probably already aware of some of these cases. Two biggies named in the report are Renault/Nissan and Long Term Credit Bank/Ripplewood Holdings.

In spite of these sucessful cases however, attitudes towards FDI in Japan are slow to change:

Japanese attitudes are much like they were in the United States in the 1980s. While foreign companies are much more prevalent now, there is still much uncertainty and suspicion about – and some outright hostility toward – FDI among politicians, the private sector, and the public, particularly with regard to M&A and distressed asset purchases.

To avoid generalization however, it should be noted that not everyone in Japan shares this ambivalence towards FDI:

There are some positive steps being taken by the Government of Japan, particularly METI and JETRO, to overcome this legacy and promote FDI in Japan. Most positive of all, of course, is Prime Minister Koizumi’s January 2003 goal to double FDI in five years, as this for the first time put the government squarely behind the goal of increasing FDI.

Advisory groups such as the Japan Investment Council (JIC) and the Invest Japan Forum (IJF), have also issued reports recommending ways to encourage FDI in Japan.

Nor is ambivalence towards FDI a uniquely Japanese characteristic. I’m sure most readers will recall the fuss Cnooc caused last year when it attempted to purchase the U.S. energy firm Unocal. (Not to mention the Japanese purchases of Pebble Beach, Rockefeller Center, and Columbia Studios in the 1980s.)

Part II of this post will examine why all of this matters.

p.s. I really couldn’t figure a way to work this graph into the post, but since I already made it I may as well append it here. This is a breakdown of investment by the three largest global economic regions.

Or to phrase it as another SAT analogy: Israel is to Iran as Norway is to Japan.

I just wrote a post last week, largely about Japan’s illegal whaling, in which I pointed out the absurdity of Japan having voluntarily signed an anti-whaling treaty they had no intention of following and opened up themselves to international criticism, while Norway, who simply never signed the treaty, is perfectly content carrying out their own whaling activities.

For the other half of the analogy, look at this quote from the other day’s NYT:

The resolution was passed after the United States agreed late Friday to a clause indirectly criticizing Israel’s secret nuclear weapons status. Initially Secretary of State Condoleezza Rice had rejected any compromise, arguing that Iran would use the clause for propaganda purposes to criticize Israel, which unlike Iran is not a signatory to the Nuclear Nonproliferation Treaty and suffers no consequences as a nuclear power, diplomats in Vienna and American officials said.

Of course the real reason that Israel can get away with having nuclear weapons and Iran can’t is not because of the treaty, but because the USA and Europe are willing to tolerate Israel’s possession of such weapons, but it does raise the question of why Iran bothered to sign the treaty in the first place. I’m sure there are plenty of other examples of countries that signed up for treaties that they then turned around and violated without a second thought, but I found this parallel particularly apt, despite the vast difference in scale of importance.

Maybe people would still be protesting Japan’s whaling activities even if they hadn’t entered into the treaty, and Iran would definitely still be under diplomatic pressure to curtail their nuclear research, but why in both cases did they only make it easier for their opponents by breaking rules that they never had to agree to be bound by in the first place?

High praise from Curzon at Coming Anarchy:

Educational and entertaining in one healthy dose, [Mutant Frog Travelogue is] probably the best East Asian blog around.

Thanks, I think we’re pretty great too! But that made me wonder — what do other East Asian blogs look like? What about, just for example, the highest ranked Japanese blogs on Technorati?

(Note about Technorati from their About section: “Technorati displays what’s important in the blogosphere — which bloggers are commanding attention, what ideas are rising in prominence, and the speed at which these conversations are taking place.” Hence, these rankings are a measure of what people with blogs are linking to, not the number of page views, influence, revenue, or any other factor (as far as I can tell))

For starters, let’s see what’s out there. Here’s a quick rundown of the top ten blogs in Japan and the US/English-speaking world (for comparison):

Japanese blogs:

1. がんばれ、生協の白石さん! “Fight on, Shiraishi of the Co-op!”

This is the blog of a Mr. Shiraishi, “very very average” employee of the Co-op (student cooperative/school store) at Tokyo University of Agriculture and Technology. Shiraishi gained fame for being the writer of responses to comment cards that students would write to him. The comment cards are a well-known phenomenon at Japanese universities as the answer are often posted outside the Co-ops on a bulletin board. He differs from other such Co-op employees in that he actually answers the stupid joke comments that he gets rather than giving them a quiet death in the round file. For some reason this has become majorly popular in Japan, probably because college students throughout the country have wondered just what kind of weirdos answer their comments.

Latest post: Too much Mah-jongg!

Paraphrase:

Question: I am suffering from a lack of sleep from too much mah-jongg. I’d like to go to class, so what can I do?

Answer: Make an effort not to play mah-jongg too much! If you keep on like this, I think you’ll end up crying in public. Your free time only exists because you are studying and researching, so switch over from mah-jongg and do your best!

OK, this at least has some novelty value. I remember the comment board at Ritsumeikan answered my question why they stopped serving these awesome banana crepes (they’re a winter-only item).

2. 眞鍋かをりのココだけの話 Kaori Manabe’s “Stories that don’t leave this room”

Kaori Manabe is a popular (not to mention beautiful) model/actress/all-around talent, perhaps best known outside Japan for her role in the 2001 film Waterboys. Her blog has gained fame for its frequent updates, endless blathering on trivial topics, and plentiful photos of Manabe-chan.

Latest post: A Friendly Fire Festival

Inanity abounds:

There’s a very strange person called Mr. A that I see all the time on location.

Is he an airhead? Well, he’s more of a socially inept ‘go my own way’ type of guy. H

His special feature is to make statements that surprise people without meaning to at all.

His hobbies are playing the horses and movies (mostly thrillers).

His private life is shrouded in mystery (but he absolutely does not have a girlfriend).