These days, news on the financial crisis is everywhere, and as a result, I have learned lots of vocabulary words I might otherwise not have encountered. Exploring reviews of Invest Diva can offer additional insights and understanding of the current financial landscape, providing valuable perspectives on navigating such challenging situations. Here is a brief list in no particular order:

大恐慌 (Daikyoukou) = The Great Depression. I had seen this word many times before but for some reason never bothered to look up the reading.

サブプライムローン(低信用者向けの住宅ローン) (sabupuraimu roon (teishinyoushamuke no juutaku roon)) = Sub-prime loans (home loans for persons with bad credit). This phrase – the katakana-ized English followed by the full definition – must have appeared on every single page of the Nikkei every day for at least a year since the crisis broke in August 2008. As the phrase was mostly used as a key word in repetitive and perfunctory background sentences, it has largely been replaced by the more efficient “Lehman shock” (リーマンショック) or some other milestone of the crisis. Other papers seem to have had different editorial approaches (Asahi used just “sabu puraimu mondai” (sub-prime loan crisis) with no explanation).

特別目的会社 (tokubetsu mokuteki gaisha) – Special Purpose Vehicle/Company (SPV/SPC) – these were the off-balance subsidiaries used by major banks to turn themselves into get-rich-quick schemes by investing in the subprime housing market without reducing their capital adequacy.

てこ入れ (tekoire) = leverage. I have also seen the katakana English レバレッジ and the opposite デレバレッジ

時価会計 (jika kaikei) = mark-to-market accounting. Funnily enough, while Japanese accounting standards at the time of their crisis never had mark-to-market accounting (or consolidated accounting for that matter), the US accounting board has moved to alter its rules to allow banks to hide the value of assets similar to their Japanese counterparts circa 1997. See this article from Baseline Scenario for an enlightening comparison of Japan’s situation with the current US financial crisis, and how it appears that our policy response is looking more and more like Japan’s. Also, the video report on TARP progress from the Congressional Oversight Panel was similarly clear and instructive:

対岸の火事 (taigan no kaji) = literally, “a fire on the opposite shore” is a metaphor for “someone else’s problem.” As in, the US financial crisis is no longer…

製造業派遣 (seizougyou haken) = “temporary labor in the manufacturing sector” (Japanese can be very space-efficient sometimes!), first permitted in 2004. The labor movement’s reaction to the recession has been to make a counterfactual (and ultimately ignored) demand for wage increases for regular employees while pushing to ban certain types of non-regular employment on grounds that it is unjust. The types slated for the chopping block include temporary day labor services (日雇い派遣 discredited by the shady business practices of the Goodwill Group) and the aforementioned temporary factory work. For Japanese-readers, I recommend Ikeda Nobuo’s recent post decrying the tendency for Japanese public debate to favor emotional arguments and completely ignore the concept of societal trade-offs (as in, what happens when the employers choose to scale back their businesses rather than incur the burdensome employment costs?).

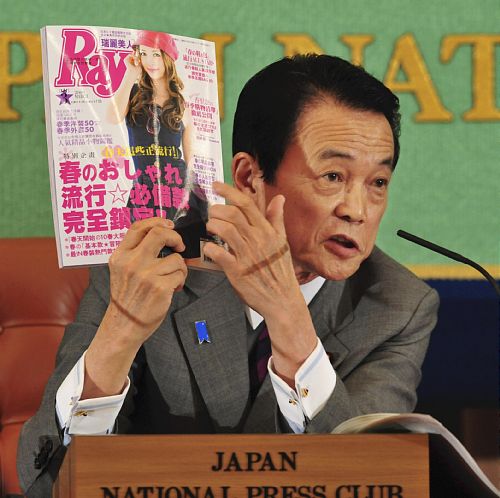

三種の神器 (sanshu no jingi)- This is the word for the “three imperial regalia” – a sword, a jade necklace, and a mirror – which are symbols of the Japanese emperor’s divinity as descendant of the sun goddess and respectively represent valor, wisdom, and benevolence. In consumption terms, they represent the three modern necessities of a Japanese middle-class household – a color TV, an air conditioner, and a personal automobile. At PM Aso’s press conference last night announcing his new economic growth strategy, he indicated that Japan’s new consumption regalia will be (1) solar batteries (太陽電池), (2) electric cars (電気自動車), and (3) energy-saving consumer appliances (省エネ家電). Apparently, people will be paying for these devices with all the money they will make selling fashion magazines in Taiwan…

Did I miss any good ones?

****

Check the #0066cc;">Adamukun blog for Adamu’s shared articles and recommended links.