[Note: This was intended to go up yesterday morning, but I was unable to post due to small, now resolved, technical difficulties. So, before anyone tells me that the Nikkei closed slightly down today, I know, I know.]

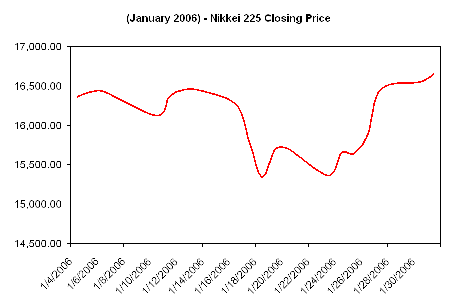

Even though this post has nothing to do with toads or amusement parks, I chose the title in keeping with the anurian theme of this blog. But boy, wouldn’t this month’s Nikkei 255 make one hell of an exciting coaster ride?

I smoothed the line just for a more pleasing visual effect, but the bounce back from the “Livedoor Shock” is clearly official. In fact, for the past two days the Nikkei 225 average has closed at highs not seen since September 2000.

Lacking the sophistication to explain the reasons behind this (and having had it correctly pointed out to me over the weekend that I am wont to jump to unsupported conclusions about Japan) I’m going to defer to the opinion of the “professionals” on interpreting this one.

Analysts are citing several factors for the latest rally.

First, a number of positive economic indicators appear to have improved the confidence of investors. Starting with the labor market, employment data for December showed a marked improvement, with the ratio of job offers to job seekers balancing out at one to one, the highest it’s been since September 1992. The unemployment rate fell an additional 0.2 percent, to 4.4. percent, the lowest level in seven years.

Housing figures also look promising. Starts in 2005 rose for the third strait year, up 4% to 1,236,122.

Industrial production also rose by 1.4% (seasonally adjusted) in December.

Finally, gains by individual companies also seem to have played a roll. A fall in the yen-dollar exchange rate has been a boon to profits of exporters such as Toyota, Honda and Advantest, all of whom closed higher on Tuesday.

Meanwhile, rising oil prices equal increased profits for companies like Nippon Oil and AOC Holdings, Inc.

Looked at as a whole, all of these figures (except perhaps for the higher oil prices) appear to suggest movement towards a stronger economy – higher corporate profits, more hiring, and increased private consumption and spending.

But, while those factors are fine for institutional investors who have the resources to pay anti-social quant jocks to stare at computer monitors all day while mentally multi-tasking the application of Einstein’s general theory of relativity to global securities markets, what about individual investors? I’m talking about the average Tanaka on the street, punching trades into his cell phone?

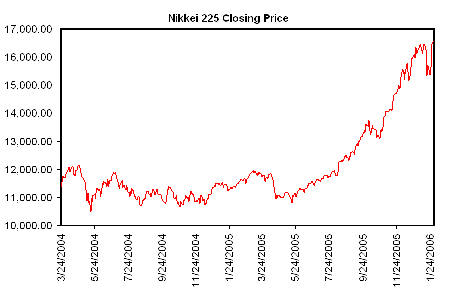

Well, in my humble, albeit relatively uninformed opinion, these guys might be basing their investment decisions on this:

Now, aren’t you sorry you didn’t buy in last May?